Know Your Customer Solutions

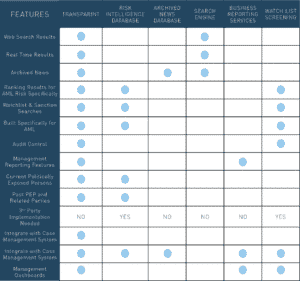

Transparint solves the problems anti-money laundering and financial crime analysts face daily when they use traditional risk databases: the fear of the unknown.

Our platform uses machine learning and natural language processing to filter vast quantities of unstructured data from millions of sources to efficiently identify financial crime and reputational risk. Our artificial intelligence solution contains a relevancy scoring algorithm to dramatically reduce your false positives. Traditional negative news products look at only a small fraction of publicly available information. This means institutions miss crucial information that should be influencing risk management decisions about customers, counter-parties, and beneficial owners. Combing through page after page of results from negative news providers and commercial search engines wastes time, increases costs and degrades compliance.

Advanced Search Capabilities

- Search, in real-time, more than 10 times the amount of negative news and risk information than other databases

- Collects all relevant negative news, sanctions, watch list and PEP in one system

- Reduce false positives using our advanced matching science to calculate and display a Relevance Score for each result

- Contains built-in case management – track searches, results, and progress identifying potential capacity, aging, and backlog issues

Screening and Monitoring of Customers and Third Parties

- Screens in real time against 5.5 million sources

- Easily load lists of individuals and businesses and monitor those names against real-time negative news

- Actual Real-Time monitoring. Be alerted as new negative news is published

- Search more sources than any other negative news application

- Investigate and resolve alerts directly in case management dashboard

- Complete control over alert assignments, escalations, and dispositions

- Full audit, analytics, and manager reporting capabilities

API Access

- Gain access to negative news, watchlist, and PEP data through Transparint’s application programming interface (“API”)

- Add Transparint search results to internal systems to save time and limit the use of multiple applications

Intelligent Risk Profiles

- Access to millions of profiles that are constantly updated and sourced via our artificial intelligence engine

- Consolidated data set of profiles for individuals and entities involved in financial crime or reputational risk events

- Machine learning and natural language processing leveraged to identity risk events in near real-time from unstructured news, providing an unmatched level of data coverage

Conduct Risk-Based Due Diligence

- Confidently conduct risk-based diligence with our fixed-cost investigations – from open source to field level investigations

- Leverage our global analyst network with due diligence engagements in more than 190 countries, covering more than 40 languages

- Access our expertise – with over 220,000 due diligence investigations annually, Transparint has the infrastructure and methodology for conducting and managing due diligence globally

Unburden Your Compliance Team

- Leverage global team of analysts to conduct first level reviews of alerts saving internal analysts time

- Data aggregation, validation, and cleansing

- Project management

- False positive remediation

- Ultimate beneficial ownership investigations

Click below to download a PDF of this brochure.

Back to Insights

Back to Insights