Due Diligence

Better Intelligence, Better Decisions

Leverage a powerful combination of human research

and AI-driven monitoring and screening.

Learn the five practical steps to overcoming the challenges of implementing a risk-based third-party due diligence program.

Accurate and Timely Intelligence at an Unmatched Value

As global regulators are increasingly noting that a “check the box” third-party due diligence program is no longer sufficient to effectively mitigate risk, access to reliable, effective intelligence is critical to creating and maintaining a credible and defensible compliance program.

Building a risk-based program requires access to the full complement of third-party due diligence tools available in the market. This includes access to database queries to screen against known watch lists, Artificial Intelligence (AI) search tools to proactively monitor for media-based risks, desktop research capabilities in local languages to identify both direct and circumstantial red flags and “boots-on-the-ground” investigational capabilities to gather intelligence only available locally.

For over 20 years, the biggest brands in the world have been relying on Steele’s Due Diligence Services to provide critical insights for the onboarding of third parties, vendors, customers and suppliers.

Steele has best-in-market capabilities across all levels of third-party due diligence, enabling clients to build a seamless, comprehensive and global third-party due diligence program.

Get your team the intelligence they need to assess third-party or supplier risk. Talk to an expert today.

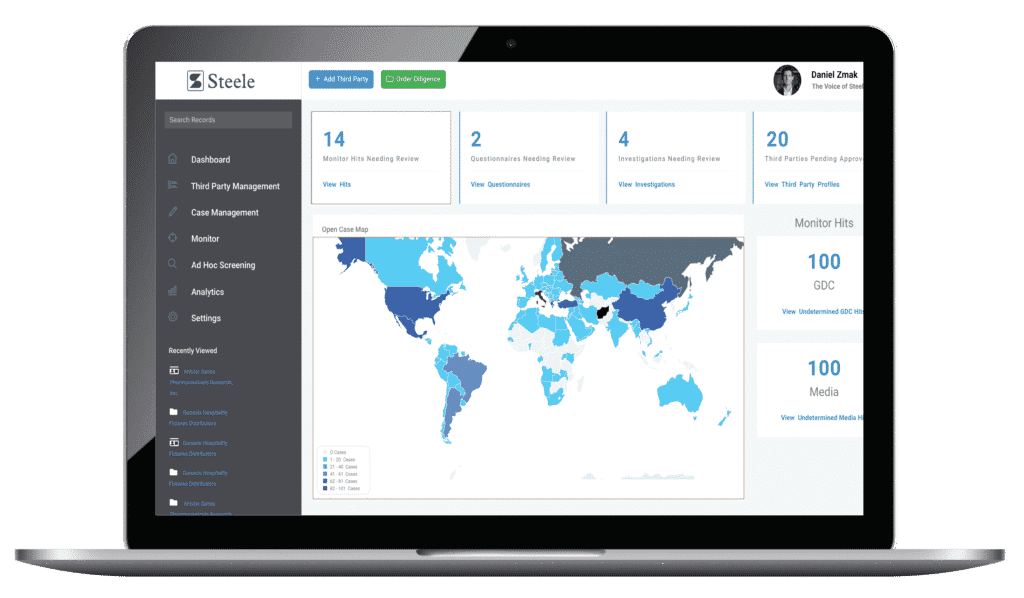

Database Screening & Negative News Monitoring

Steele’s patented, negative news monitoring and database screening application, Risk Intelligence Data, uses AI and natural language processing (“NLP”) to filter vast quantities of unstructured data from hundreds of millions of sources to efficiently identify risk potential. Risk Intelligence Data services provide greater real-time coverage of negative news and risk information than other commercial databases, and our dataset delivers fewer false positives by using machine learning to calculate and display a Relevancy Score for every result. These tools allow for efficient and cost-effective monitoring of all third parties, enabling you to expand your due diligence reach across your third-party universe.

Global Database Checks (GDC)

Comprehensive screening capability that screens against 1400+ watchlists, sanctions and embargo lists. Our datasets are updated in real time to reflect current events. Additional lists identifying parties in higher risk industries such as marijuana related businesses (MRB) and money service businesses (MSB) are also available.

Adverse Media Monitoring

Steele’s patented search & monitoring system provides greater real-time coverage of negative news and risk information than any other commercial databases. Our dataset delivers fewer false positives by using machine learning to calculate and display a Relevancy Score for every result.

State Owned Enterprises (SOE)

Our comprehensive global SOE database is an essential tool for mitigating third-party and/or Know Your Customer (KYC) compliance risks. The dataset includes enterprises where the state has control through full, majority or significant minority ownership in state entities, regional and local SOEs, affiliates to SOEs and controlled entities, central or national bank and international organizations.

Learn more about our Risk Intelligence Data datasets.

300+

Desktop

Analysts

500+

Field

Investigators

50+

Languages

190+

Countries

Human Driven Intelligence

Our experienced Due Diligence Services team has been conducting global integrity third-party due diligence for over two decades. Our services are designed to be scalable and tailored to your business, while providing reliable, insightful information aligned with global regulatory expectations. When our team becomes your team, your compliance organization is bolstered by the support of hundreds of compliance professionals focused on ensuring you have the right information at the right time to make good business decisions about partners and customers.

Our services are designed to be scalable and tailored to your business and can include a number of scope elements.

Desktop Investigations

Our desktop research team is comprised of highly skilled and educated professionals coming from wide ranging backgrounds, including legal services, law enforcement, government intelligence, international business management, journalism and library sciences. Steele provides your team with a business intelligence report based on in-depth online research and human analysis using open sources, that can include:

- Global Database Check (GDC): screening against more than 1,400 sanctions, embargo, politically exposed persons (PEP) and government watch lists

- Provides comprehensive online research and human analysis using Steele proprietary search methodologies,

- Conducted in both English and the local language, this report provides your team with a comprehensive inquiry both locally and globally to ensure that even obscure findings are identified.

- Identifies relevant information about the entity’s integrity, business connections and political connections, curated by human analysts and supported by our proprietary AI negative news search, sanctions and watchlists screening tool, Risk Intelligence Data

Field-Based Due Diligence

Steele’s team of field investigators are all highly-trained with backgrounds in government intelligence, military and law enforcement. They all possess proper local investigator licensure and credentials, and all maintain a deep understanding of and strict adherence to providing only legally obtainable information. This report is based on extensive local field research, with the addition of in-depth online research and human analysis, all conducted in English and the local language. It will include all the elements of the open-source investigation plus:

- A local, operational site assessment and verification to ensure the partner’s business is operating in the location listed

- Local reputational inquiries to identify both compliance and business-related risks

- Local media research to augment the work by the open-source researcher

- Registry and ownership records review

- Financial records review

- Local and national criminal and civil litigation records search

- Political exposure inquiries

Let us help customize a risk-based due diligence strategy for your organization.

Additional Available Defined-Scope Investigations

Steele Identified Principals

Uses Steele’s proprietary research techniques and screening methodology to identify the appropriate individuals to investigate and vets up to three principals of a third party.

Beneficial Ownership Investigation

Various levels of investigations are available from open-source research to field-level reputational assessments of individual persons with 25% ownership or more in the primary entity.

Corporate Social Responsibility Investigation

Open-source investigations of subjects within the client’s supply chain to identify issues of relevance relating to human rights, labor rights, environmental concerns or concerns related to ethical and sustainable sourcing.

BIS Investigation

Desktop investigation identifying military end use or end-user customers in China, Russia and Venezuela to help meet the new requirements identified by BIS for Export Administration Regulations (“EAR”).

In-Country Records

An investigation to identify adverse findings related to the registration, ownership, and the registered address from field-obtained, official registration records and in-country litigation checks by field investigators.

In-Country Research China

Open-source research that identifies the registration, ownership, key personnel, and registered address from online AIC records and includes litigation checks.

M&A Due Diligence

Steele’s M&A Due Diligence provides risk-based levels of due diligence investigations to vet an acquisition target’s third parties. Advisory Services can be included to assess the state and effectiveness of the target company’s corporate compliance program and identify key issues for post-closing compliance program integration.