Risk Intelligence Data

More Relevant Results, Fewer False Positives

Our patented, AI-powered search and monitoring platform provides greater real-time coverage of negative news and risk information than any other commercial database.

Learn how you can use quantitative analytics to enhance your compliance system. Watch our webinar: Transforming Data Flows Into Actionable Insights

Real-Time Data, Better Results

Making decisions without finding all adverse information harms compliance and puts people and companies at risk. Provide your teams with a better way to find the most relevant results and decrease false positives through our unique, patented data service.

Our real-time data can easily integrate into any internal or third-party platform to decrease risk, save valuable time, and ensure more effective decision-making.

- Uses Natural Language Processing and Machine Learning to scour published information sets exponentially larger than any curated database or archived news library

- Supplements the gap of traditional databases by providing your team with an unmatched level of data coverage

- Relied on by leading corporate and financial institutions to manage ABAC and AML risk posed by key customers and vendors

Automated real-time monitoring and search tools for negative news, watchlist, sanction, and politically exposed persons data. Protect your institution from reputational, AML, and financial crime risks.

Your Challenge:

The Flood of Risk Information

Every day there are more than 40,000 new risk records produced from public and government sources including:

- News Reports

- Sanctions

- Watchlists

- Most Wanted Lists

- Politically Exposed Persons

- Corporate Records

- High Risk Sources

Steele’s patented method allows us to scour more publically available information than any other application.

Data mined from

over 5 million

sources.

Risk records on

over 40 million

entities and individuals.

Global data from

over 160 different

countries.

The Largest Real-Time Source of Negative News and Risk Information

Adverse Media / Negative News

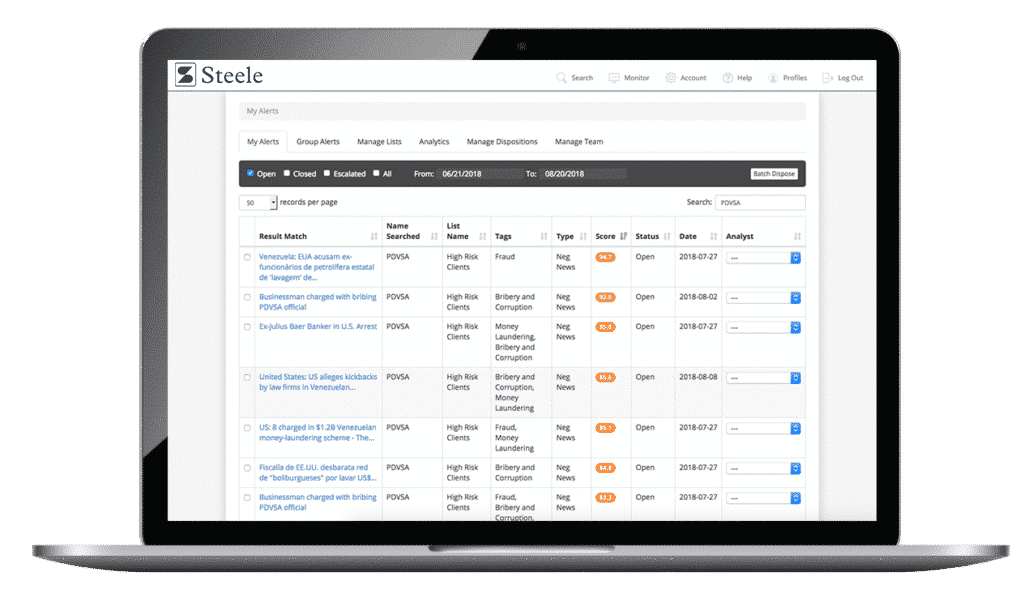

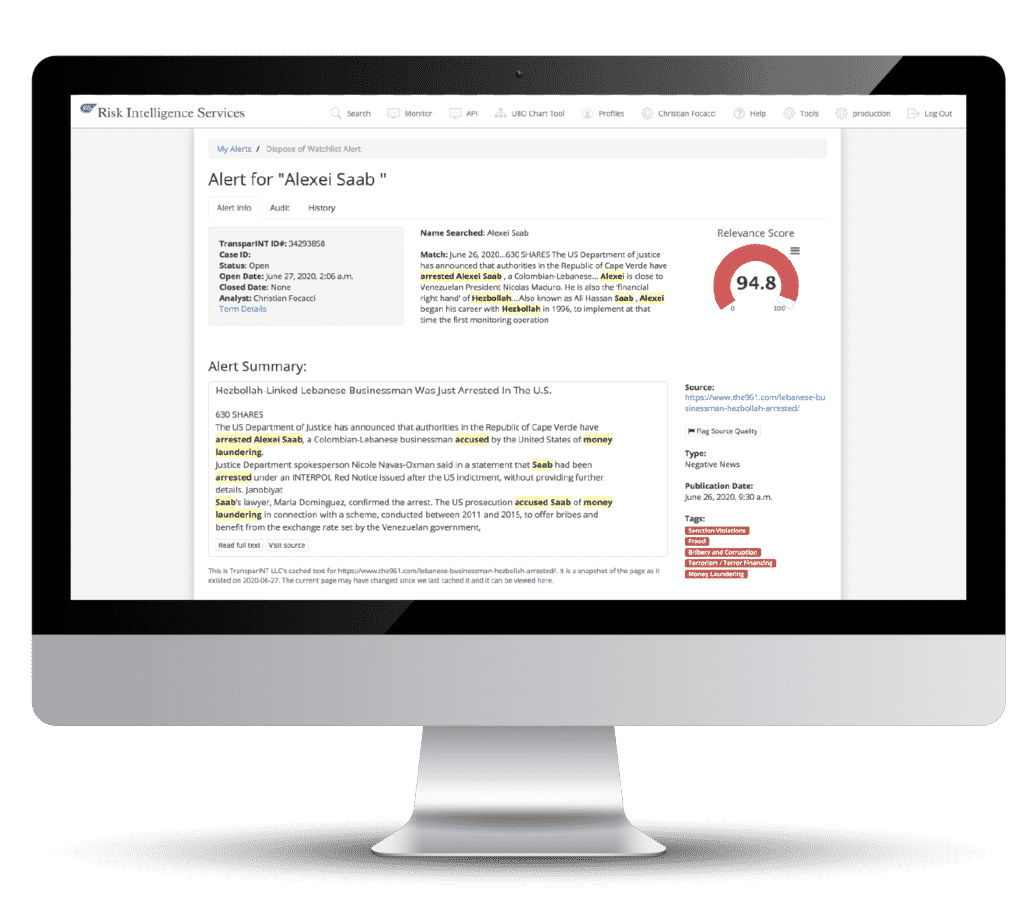

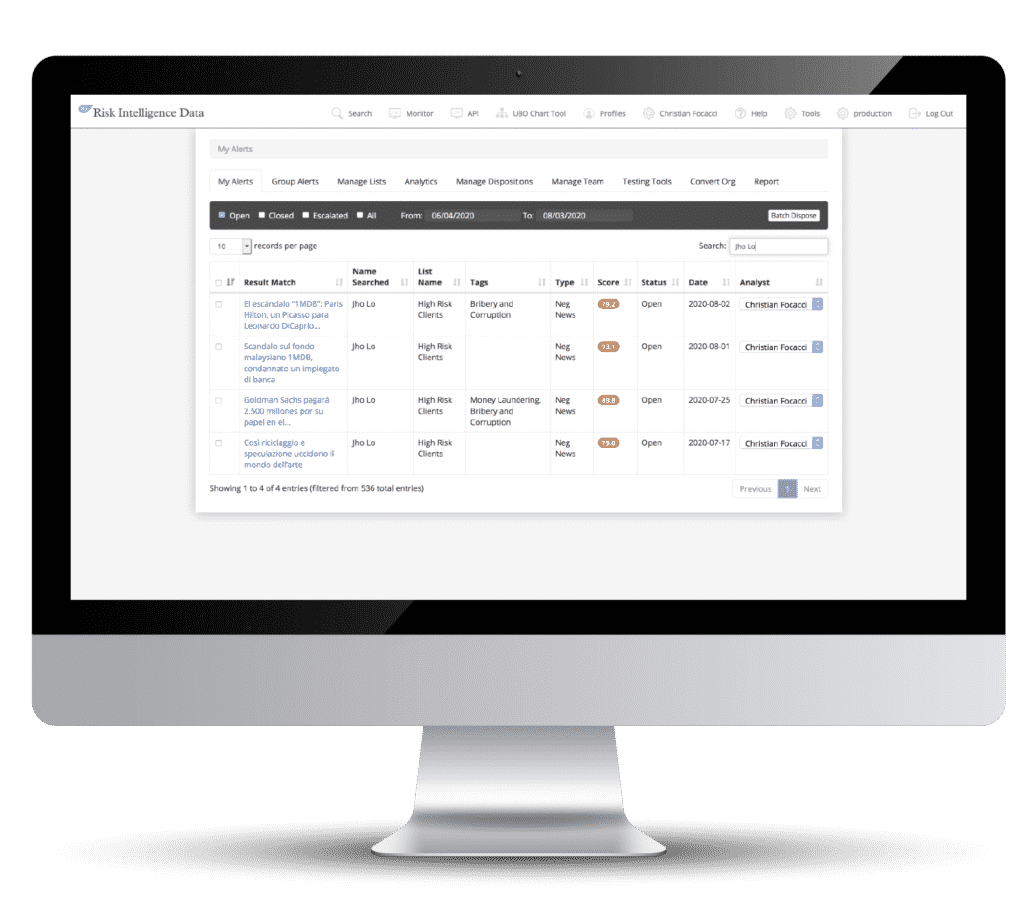

Steele’s patented search and monitoring system provides greater real-time coverage of negative news and risk information than other commercial databases. Our dataset delivers fewer false positives by using machine learning to calculate and display a Relevancy Score for every result.

Watchlists / Sanctions

Comprehensive screening capability that screens against 1400+ watchlists, sanctions and embargo lists. Our datasets are updated in real time to reflect current events. Additional lists identifying parties in higher risk industries such as marijuana related businesses (MRB) and money service businesses (MSB) are also available.

Politically Exposed Persons (PEPs)

A comprehensive list of Politically Exposed Persons around the world. Updated regularly, our list includes:

- Heads of state, members of parliament and other government officials

- Military officials

- Highest members of the judiciary

- National bank governors and members

- Political and religious leaders

- Relatives and other closely associated persons to PEPs

State Owned Enterprises

Our comprehensive and global SOE database is an essential tool for mitigating third-party and/or Know Your Customer (KYC) compliance risks. The dataset includes enterprises where the state has control through full, majority, or significant minority ownership in:

- State entities

- Regional and local SOEs

- Affiliates to SOEs and controlled entities

- Central or national banks

- International organizations

Beneficial Ownership

Provides a user interface to chart simple or complicated ownership structures. Once the structure is mapped, there is an ownership calculation feature that determines the percentage owned of the target company through each parent company back to the individual owners. This streamlines the process of charting and calculating ownership percentages to meet CDD rules.

- Create ownership charts with our easy to use web interface.

- Map ownership through corporate structure to identify beneficial owners.

- Export charts as image files to upload or use in reports.

- Save charts to edit or revisit at anytime.

Business Disruption

Steele’s Business Disruption dataset identifies customer and vendor risk through early detection of business deficiencies during a crisis, such as the COVID-19 pandemic, so they can be prioritized for risk exposure and proactive mitigation strategies.

- Isolates records showing key signs of business deficiencies and overall early warnings to profitability & stability issues including: degrading of value, financial health, employee furloughs or layoffs, bankruptcy, etc.

- Continuously monitors global media for reports of financial distress or business disruption to mitigate supply chain and merchant risk exposure

Interested in Joining the Steele Partnership Ecosystem?

Steele’s Risk Intelligence Data services offers a reseller program designed to empower you with the resources and tools for success. Our flexible partner models can help you increase revenue and deepen relationships with your clients.

Learn More

Let us show you how today’s global enterprises are using Steele’s platform to transform their compliance programs.

The Enhanced Due Diligence group for a large bank needed a way to not only conduct negative news searches, but also to ensure the entire team used a standardized process. Risk Intelligence Data enabled each team member to quickly access the most comprehensive list of media, news and watch lists results. All results were processed through the tool’s proprietary algorithms to ensure strict compliance standards. In less than two months, Risk Intelligence Data uncovered over a dozen relevant results that were not found in any conventional databases. These results were actionable and impacted on-boarding decisions.

Facing tight deadlines and high regulator expectations, a large financial institution leveraged the Risk Intelligence Data Batch Search Solution on a project to screen a list of over a thousand high risk counterparties for adverse media. Completed in less than two business days, the search identified several parties with significant instances of negative media, including prior money laundering convictions, and connections to terrorist financing. The search also identified two separate entities located on domestic and international sanction lists. By leveraging Risk Intelligence Data’s technology and industry expertise, the bank saved significant time, risk and resources as completing this project through traditional means would have taken several weeks.

Tasked with conducting thousands of searches for a large project, a big four consulting firm leveraged Risk Intelligence Data’s point of use platform to search and document their results. Based on Risk Intelligence Data’s ability to aggregate and process numerous disparate sources, a small group of consultants were able to quickly generate in-depth reports for each search subject. The project, which was estimated at 10 days, was completed in less than 2. Risk Intelligence Data not only provided the most comprehensive results, but was also more efficient than traditional processes. The platform’s enhanced reporting and audit features are exclusive to Risk Intelligence Data.

An investigator from a large international financial institution needed to find information about wire transfer originators and beneficiaries who were not customers of his bank. He knew that the risk intelligence database his bank used often missed negative news information. Internet search engines often found information the risk intelligence database missed, but the search engines returned too many general results which took too much time to page through. Using Risk Intelligence Data, the investigator was able to find the relevant adverse media missed by the database, and because Risk Intelligence Data also includes results from all major search engines and prioritizes those most relevant to AML, the investigator was able to finish cases faster, and with a greater sense of confidence that all available information was found.

A due diligence analyst for a bank that provides Alternative Investment Services needed to know if the beneficial owners of a hedge fund presented AML or financial crime risk. Without any identifying information about the owners, such as addresses or age, the analyst was unable to rely on a risk information databases. A general search of the internet returned hundreds of results, none of which seem related specifically to the beneficial owners, although without reading each result, the analyst could not be sure. Risk Intelligence Data, because it is programmed to look specifically for AML and financial crime related risk, was able to identify four adverse media reports in which the beneficial owner was the subject of a regulatory investigation.