Know Your Customer

Know Your Customer (KYC) compliance is a critical function to assess customer risk to comply with global Anti-Money Laundering (AML) laws, but many institutions may be missing crucial information that should be influencing risk management decisions.

Current industry practices for complying with updated KYC regulations fall well short of fulfilling regulatory requirements. Learn the best practices for complying with changing AML laws.

Protect Your Institution From Reputational and Financial Crime Risks

Know Your Customer is the fundamental practice of protecting your organization from fraud and losses—and protection from possible fines, sanctions and reputational damage. But not all AML/KYC solutions are created equal.

Traditional negative news products look at only a small fraction of publicly available information. This means institutions miss crucial information that should be influencing risk management decisions about customers, counterparties and beneficial owners. Combing through page after page of results from negative news providers and commercial search engines wastes time, increases costs and degrades compliance.

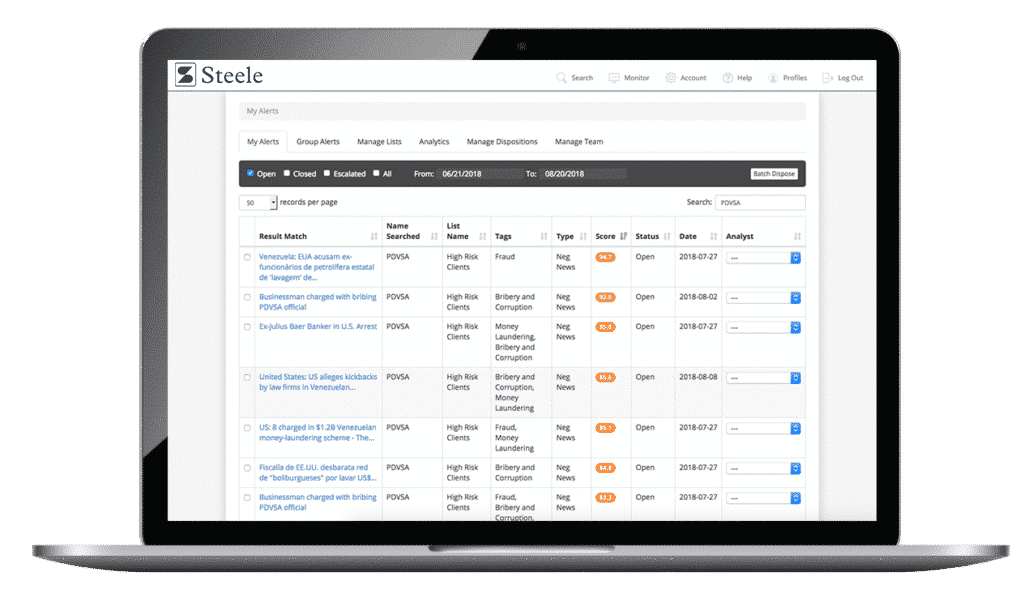

Real-time Monitoring & Search

With Steeles Risk Intelligence Data, your team can search more information than any financial crime risk database and reduce false positives with our patented relevancy scoring.

- Real-time monitoring and search tools for negative news, watchlists, sanctions, and PEPs.

- Advanced automation simplifies searching and slashes file documentation time.

- Built-in case management to track searches, results, and progress in identifying potential capacity, aging, and backlog issues

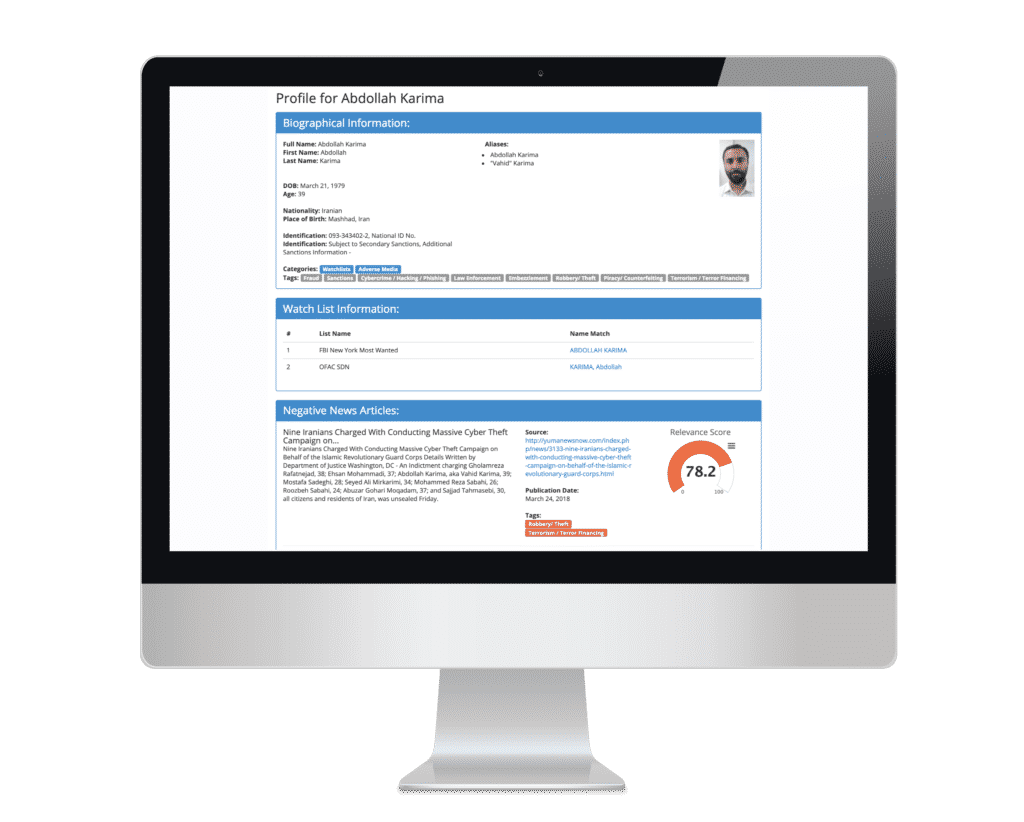

Intelligent Risk Profiles

Access millions of profiles that are constantly updated and sourced via our artificial intelligence engine.

- Consolidated data set of profiles for individuals and entities involved in financial crime or reputational risk events

- AI-powered to identity risk events in near real-time from unstructured news, providing an unmatched level of data coverage

Due Diligence & Alert Reviews

Steele Due Diligence Services has best-in-market capabilities across all levels of due diligence, providing the intelligence you need for deeper dives on high-risk customers.

- Leverage Steele’s global team of analysts to conduct first level reviews of monitoring alerts saving internal analyst time clearing alerts

- For enhanced diligence needs, leverage our highly trained team of desktop analysts & field investigators