Introduction

Beneficial ownership continues to be a frequently discussed topic in the compliance space. The dialogue includes the importance of determining and maintaining a public database of beneficial ownership structures, the challenges of doing so, and, in some instances, the secrecy and complexity surrounding ownership structures and using threshold ownership percentages to define compliance. Understanding an entity’s beneficial ownership structure is a requirement under various anti-bribery and anti-corruption, anti-money laundering, and sanctions laws and regulations. The reason for the required transparency is to enable a company or financial institution to determine whether its third parties (such as a customer, counterparty, vendor, or supplier) are owned by government officials, are subject to sanctions, or require enhanced due diligence based on percentage of ownership thresholds.

In this post, one such approach to beneficial ownership structures will be examined: circular ownership. As discussed below, circular ownership structures are legal in some jurisdictions, yet illegal in others. Circular ownership structures may take several different forms and may occur in a closed or open circular setup. These structures could be simple or complex, and not necessarily easy to recognize. Most importantly, circular ownership structures can be used to mask the true ownership structure or control of an entity. The result is the appearance of ownership or control levels being at a lower percentage threshold that may not trigger due diligence or sanctions requirements (such as 5%, 25%, or 50%). However, in reality, the circular structure creates a compounding of the actual ownership share resulting in a greater percentage of control of an entity than what is apparent.

Background

At various intervals, a legal entity’s beneficial ownership structure may need to be reviewed for compliance reasons. This could occur at the time of onboarding a new client, vendor, or counterparty for a client or financial institution. This could also occur further along into the relationship, should the ownership structure or risk profile change. A review may be triggered by a change to a regulation or law. On the financial crime compliance side, FinCEN,[1] FATF,[2] and the 4th and 5th EU Money Laundering Directives[3] all have various guidance, rules, and shareholding thresholds requiring compliance screening (such as 25% for beneficial ownership.) Obtaining the identities of a third party’s ultimate beneficial ownership is a core component of due diligence under the UK Bribery Act and Foreign Corrupt Practices Act (“FCPA.”) The Office of Foreign Assets Control’s (“OFAC”) 50 percent rule necessitates that beneficial ownership be determined; companies that do not themselves appear on the Specially Designated Nationals (“SDN”) list are still considered to be blocked if they are determined to be directly or indirectly owned 50% or more by a legal person or company that does appear on the sanctions list.

Defining Circular Ownership

Circular ownership is a particular method to structure business entity ownership. Here, two or more entities in a legal structure part-own each other, ultimately resulting in a “circular” nature to the ownership structure. Furthermore, one or more of these entities may be owned and controlled by an individual, who, on the surface, appears to hold a low or minority percentage that would not meet ownership thresholds requiring disclosure or due diligence investigation, when in actuality that low percentage ownership belies actual control indirectly. By setting up a circular ownership structure, companies are able to mask true ownership and control through various and sometimes complex ownership loops.

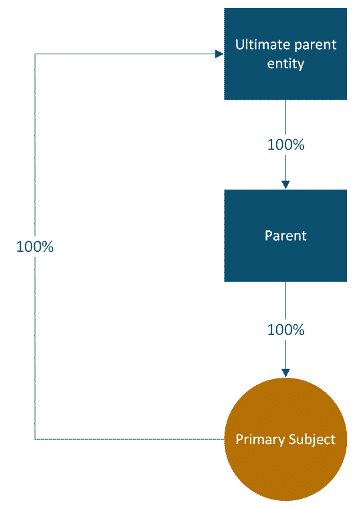

Circular ownership structures may take several different forms. For example, in some structures, all direct and indirect owners are inside a singular ownership circle. This is an ownership structure that is used with some frequency in Russian entities. In the most simplified form, it may look like this:

The primary subject entity is both the 100% owner of its ultimate parent entity and of its parent entity, in other words, the subject owns itself. This closed-circle structure makes it impossible to identify the beneficial owners of any entities within the circle.

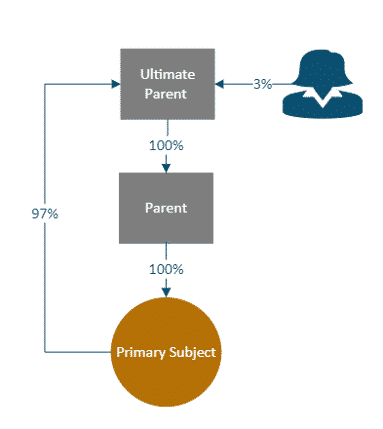

Another example of circular ownership is an open-circle structure where one or more beneficial owners are external to the ownership loop and appear to own a low percentage of shares, while in reality, these individuals may ultimately own a larger percentage of the entity. Below is a simplified example, where the sole individual in the structure ultimately owns 100% of the entities, even though it appears she only owns 3 percent. The result is that while she falls under any thresholds requiring due diligence or beneficial ownership reporting, in actuality, she is 100% the owner of all involved entities.

The Purpose and Legality of Using Circular Ownership Structures

There are legitimate reasons for the existence of circular ownership within a corporate structure. For example, circular ownership may evolve inadvertently over time as a corporate structure grows through mergers, acquisitions, and changes of control (Samsung Group is one such entity); and sometimes circular ownership structures are created for legitimate tax reasons.

Other times, however, circular ownership can be intentionally created by companies or corporate groups as a loophole to mask true ownership and control for certain purposes, including tax evasion, money laundering, and/or to avoid sanctions. The result of utilizing either of these circular ownership structures can be that the ultimate natural person owner(s) are masked through this complexity. Thus, the ultimate owner may not appear to meet a regulatory threshold such as 25% for due diligence or the OFAC 50% rule. Circular ownership structures can act as a loophole for ultimate beneficial owners to avoid detection for sanctions and due diligence purposes.

Note that the legality of circular ownership varies by jurisdiction. For example, it is legal and used often in Russia; it is legal under only certain circumstances and at low shareholding percentages in Italy, the Netherlands, and South Korea; and it is illegal in the UK and Norway, among other jurisdictions.

Elements Indicating Circular Ownership

The identification of a circular ownership structure should give rise to investigation on whether further due diligence or even sanctions reporting is required. Elements indicating a circular ownership structure may include:

- One or more entities part-owning each other

- Multiple and complicated loops of corporate ownership

- Individual owners holding a low percentage ownership, external to the circular ownership structure

- Individuals or entities external to the circular ownership structure that are targets of sanctions or export control laws

At a minimum, upon the identification of this type of ownership structure, the effect of using this structure must be considered. This may lead to an increased risk level for the individuals and entities involved, further sanctions screening, and additional due diligence into the involved parties.

Conclusion

Determining the ultimate beneficial ownership of an entity has its challenges, and the use of a circular ownership structure contributes to this complexity. Circular ownership structures may be an inadvertent by-product of a complex corporate structure evolving over time or may be set up intentionally for tax reasons. Circular ownership structures may also be intentionally created to exploit a loophole allowing ultimate beneficial owners to retain ownership and/or control over an entity while avoiding the impact of sanctions against them. Therefore, it is critical to not only be aware of circular ownership as an ownership structure and recognize it when identified during due diligence, but also to understand it as a signal that further investigation of the parties involved may be necessary.

To learn more about Steele’s comprehensive Due Diligence offerings visit steeleglobal.com/due-diligence-services.

[1] https://www.fincen.gov/sites/default/files/2018-04/FinCEN_Guidance_CDD_FAQ_FINAL_508_2.pdf

[2] http://www.fatf-gafi.org/media/fatf/documents/reports/Guidance-transparency-beneficial-ownership.pdf

[3] https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32015L0849&from=EN and https://eur-lex.europa.eu/eli/dir/2018/843/oj

Back to Insights

Back to Insights