Security Firms Counting on Compliance to Bolster AI’s Value in Banking

By Jake Martin | May 7, 2019 | Read the full article at: Bank Innovation

Compliance startups and security firms are banking on artificial intelligence playing a key role in know-your-customer/anti-money laundering processes, rather than being just a trend in regtech.

AI’s total business value in the banking world was an estimated $41.1 billion in 2018 and is projected to climb to $165 billion by 2025 and $300.5 billion by 2030, according to IHS Markit’s Artificial Intelligence in Banking report released last month. Middle-office AI solutions, including monitoring, anti-fraud and risk, KYC/AML, legal and compliance workflows, are expected to account for the lion’s share of the added value during the forecast period, increasing from a business value of $21.7 billion as of 2018 to $142 billion in 2030.

“Some people call data the new gold, but having good data on your customers is a key competitive advantage that banks are becoming more aware of as the market evolves and changes,” IHS Markit principal analyst Don Tait told Bank Innovation.

With efficiency in mind, cybersecurity firm NICE Actimize launched CDD-X, a next-generation KYC/customer due diligence product that leverages AI and machine learning for customer risk scoring. It also detects and reduces compliance risk. The company said streamlined customer review times will account for a 70% reduction in operational costs.

Stephen Taylor, General Manager of AML at NICE Actimize, said nearly 60% of the costs associated with AML are from doing customer due diligence and KYC activities. “It largely comes down to the fact that it’s a very time-consuming process, going through and managing the screening of all the potential individuals or entities that an individual organization wants to do business with,” he told Bank Innovation.

Taylor said an entity insights feature allows clients to see a CDD alert for an individual or a company in the context of a broader range of information that visualizes linkages. Automation of tasks, such as pulling beneficial ownership information and doing Google Maps searches, will also cut down on investigation times and reduce costs, he said.

“AI doesn’t get tired, and the more data you find it, the more effective it becomes,” Taylor said. “So, when it comes to reducing risk, AI is absolutely critical. It can get you a better quality result.”

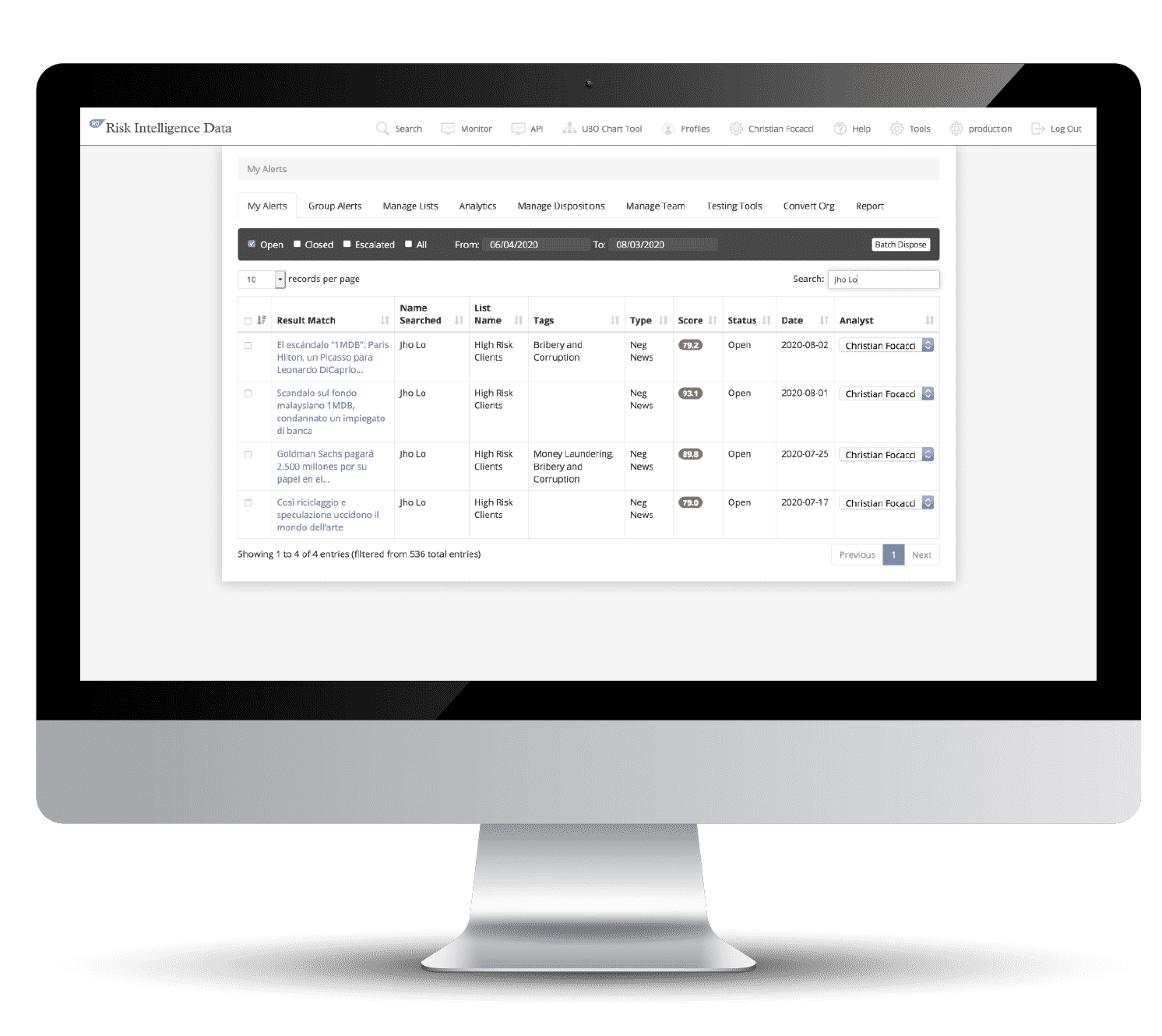

Risk management firm Steele Compliance Solutions released its AI Investigator last month, a real-time data source for identifying financial and corruption risk. The tool provides a single source for identifying risk events by using machine learning and natural language processing to deliver consolidated risk profiles based on AI-verified data from websites, sanctions/watchlist databases, company records and other sources.

Christian Focacci, VP of Product at Steele, told Bank Innovation that the company has been aggregating data for the past five years from different open sources. “We’re sitting on a tremendous amount of information, which is good, but we found ways through machine learning to do reconciliation across all of the data to identify and build profiles,” he said.

Focacci, whose previous work experience includes stints in compliance at banks such as Citigroup and JPMorgan Chase, said a lot of legacy bank software is slow, bulky and nonintuitive. He said technologies like AI and machine learning, combined with user-friendly interfaces, can significantly trim down investigation times and boost cost savings.

“When you work at banks, you just kind of get used to slow processes because that’s the norm,” he said. “One of our goals was to have a better interface, so it’s built like a modern web app. Basically, there’s no learning curve. Anyone who’s ever used a search engine can use AI Investigator, and they know exactly what they’re looking at.”

Back to Insights

Back to Insights