The Staggering Cost of Noncompliance

The risks associated with noncompliance are increasingly debilitating, and expensive. First, what do we mean by noncompliance? Regulatory compliance describes the organizational goal to ensure awareness of and take steps to comply with relevant laws, polices, and regulations. Noncompliance, then, would be a failure to ensure awareness and take steps to comply with relevant laws, policies, and regulations. For both large companies and small, today’s increasingly complex regulatory landscape and the associated costs are becoming harder than ever to ignore.

The cost of noncompliance rose 45% between 2011 and 2017, and that trend is poised to continue. In an analysis of 53 multinational companies located in the U.S. and a survey of executives, the average cost of noncompliance in 2017 was $14.8 million per company. Examples of the items counted among the costs of noncompliance are fines, penalties, business disruption, loss of productivity, and settlement costs. With an increasingly complicated and demanding regulatory landscape, the cost of compliance is rising, as well. Particularly manual, paper-based or inefficient compliance programs. However, noncompliance costs are 2.71 times more expensive than the cost of maintaining or meeting compliance requirements.

Beyond the financial costs, the reputational risks associated with noncompliance are of equally great importance in an increasingly socially conscious world of business. Negative press can harm a company’s ability to acquire business, attain grants, retain existing business, and otherwise hurt the company’s reputation for years to come.

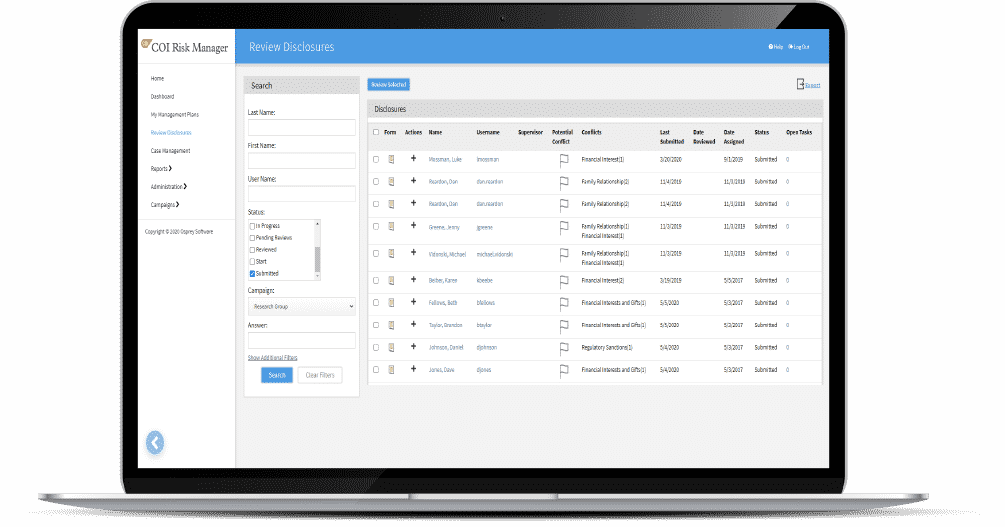

It follows logically that ensuring organizational compliance is a key priority in risk mitigation. Staying informed, implementing impactful policies, and efficient processes are all key to avoiding risks associated with noncompliance. Conflict of interest (COI) management is no different. An outdated or inefficient process for tracking and dealing with conflicts of interest can be a major contributor to the risk of noncompliance. However, the contributors to risk are not always so clear.

This whitepaper covers:

- The core fundamentals of an effective conflict of interest process.

- How to effectively raise response rates.

- How to best minimize missed conflicts of interest.

- The importance of effective follow-up in a sound COI process.

- How to build an audit trail to protect your business.

Download the whitepaper below.

Back to Insights

Back to Insights